FOB vs. CIF – confusion with the China

Import Service Fee (CISF FEE)

In international cargo transport, there exists many rules, regulations and laws whose origins are to be found in the countries concerned. The Incoterms, international trade clauses should facilitate trade and the transport of goods between two participating business partners of different countries. These provisions are to be complied with to ensure a simplification of contracts, the Incoterms FOB and CIF play a major role especially in the maritime domain.

Incoterms – cost and transfer of risk

Basically, there are regulated by the Incoterms of the cost and risk. At which the responsibility for the cargo as the freight charges of Seller shall pass to the buyer. However, this is not quite so simple because often enough there are voluntary agreements such as the Incoterms statutory provisions of the export as the importing country against which also leaves room in terms of their interpretation. Here precise the Incoterms ensure that exactly find individual laws of each country in the form of attention that they are dealt with by each resident business partners as experts on the subject. So does the Incoterm FOB (Free on Board), which the goods are placed at an agreed port of loading by the seller, loaded there and the port fees are paid. From this point, the costs and the transfer of risk passes to the buyer.

CIF (Cost Insurance Freight)

The Incoterm CIF (Cost Insurance Freight) the seller for the freight cost inclusive insurance is responsible until the port, the transfer of risk from the seller to the buyer is carried out at loading of the ship in the port of origin, the seller must inform the buyer immediately when the load has taken place. The cost of transition is carried out in the port of destination. Of course, during the movement of sea freight there are not just sellers and buyers involved, because this matter is far too complex. Rather, it is, inter alia, shipping companies and freight forwarders who handle the logistical part. To let the seller take responsibility for the cost of freight to the importing country by CIF, the buyer has the advantage that the seller must comply with all legal provisions and regulations of the exporting country. This is the responsibility of the seller. It should be noted that the goods are not available until the arrival in the port of importation under the control of the buyer.

Claims by Seller

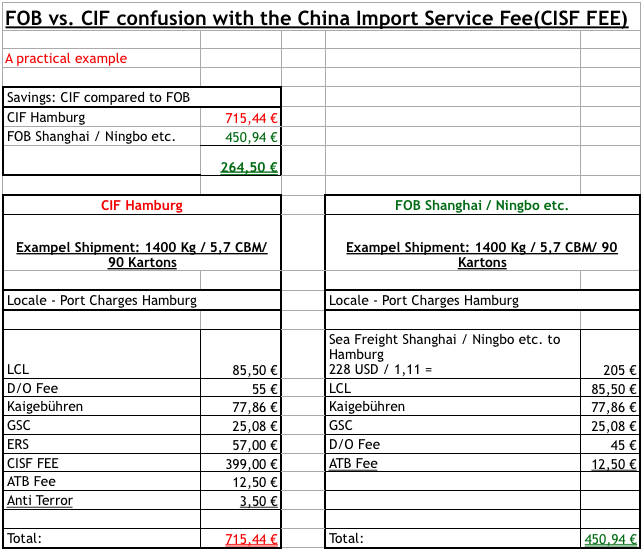

In practice, there will frequently be additional claims on the part of the seller that do not lie within the agreed sum of the freight costs previously agreed. This can, for example, be separate fees which were raised in the port of export by the local port authorities and which are not included in the terms of the agreement, since they were not in existence when the contract was signed or not known. Thus, the buyer has incalculable costs such as the China Import Service Fee also CISF FEE or India Import Service Fee Fee IISF also called suspended costs.

Blockade – delivery of the goods

If this unauthorized fee is not paid, this can lead to a blockage of the delivery of the goods at the port of entry by the carrier until its subsequent demands are met. Here at last we reach a point at which the Incoterms are no longer relevant. Now it comes to domestic commercial law and to the contents of the forwarding contract, which was indeed completed by the seller with the shipping company or the shipping company and the contents of the buyer is usually not known in detail. This is this forwarding contract a proviso that additional claims on the part of the forwarder can be collected, the German Commercial Code provides for a lien (§ 464).

It can get advanced costs to the buyer even if the freight forwarder has to store the goods. Any resultant storage costs for the goods in the import port are provided to the buyer in addition into account, should additional claims previously raised such as the China Import Service Fee Fee IISF also as fairy known abbreviated CISF India Import Service Fee not be settled without delay. Now, it could of course be argued that the seller in the exporting country of the contracting parties of the freight forwarder and the latter had to grapple with the additional claims.

But the seller is away and has all the time in the world the goods, however, are urgently needed in the importing country. Such kinds of “hostage-taking” of imported goods is to be found increasingly with suppliers from Asia who take the Incoterm CIF as a basis for this. This is a so-called “kickback” where the seller of the goods from the Asian carrier, as a thank you for the delivery of the shipment in the groupage container, receives this. This of course requires the interaction between sellers and forwarding, only in third world countries or emerging markets “gifts” may be quite valuableand complacent. So then appear at once several new fees, which all have an official document or stamp and therefore valid, whether justified or unjustified.

Incoterm FOB

Although with Incoterm FOB, the buyer is saddled with more work, but the goods are under this control from the export port. It can, of course go wrong, especially for buyers who are not familiar with the customs of the exporting country and German standards. Then there is the ignorance of the legal situation. Neither the HGB nor the German freight forwarders low apply here. Rather, the buyer is dependent on a reliable partner who is represented with at least one office in the port of export and know how things are properly run.

Incoterm FOB in the purchase contract

With Incoterm FOB in the purchase contract, the buyer can choose both the forwarding as well as the shipping company which transported his cargo from the port of export, and does not have to fear that the goods are loaded on a rusted ship that requires a corresponding amount of time for the crossing and increases the risk of total loss. Of course, an appropriate cargo insurance must be taken out, but this covers only the value of goods, not the cost of the need for replenishment and no losses from lost business. If the Incoterm CIF or FOB Incoterm are chosen, they describe the advantages and disadvantages. Certainly, to relate to ship the correct handling of the CIF Incoterms just for more novice importers this is the easier way goods from overseas. But this requires a good deal of confidence that needs to be paid dearly under circumstances in retrospect. The old adage that experience makes you clever will remain, however, such experience may also lead to common mistakes life-threatening traits.

Conclusion

That’s why it pays to use the experience of other buyers advantages if this is available. Often enough, these losses are the purchase contract of the affected companies and not made public due to unauthorized additional claims concerning CIF, on the one hand not to ruin their business and on the other not to embarrass themselves in front of the competition. The best and safest way of goods import is the appointment of a German forwarding agent that has many years of experience with the respective export country and this can be proved by means of references. This does not have to cost more, and is also safe. Anyone who is an a shopping spree in Asia countries and is urgent to sign a purchase contract with the incoterm CIF in order to recieve the goods should think twice. The price may seem temptingly low, however, if the value of the goods exceed the allowed company spending limit due to the chosen incoterm CIF, unidentified extra costs could occur. Therefore, it is advised that the incoterm FOB is chosen to minimalize cost and the risk of the buyer.

Write a Comment